The art market in 2024 is showing significant changes and new possibilities, influenced by the evolution of digital technology and international economic conditions. While NFT art and online galleries continue to draw attention, traditional paintings and sculptures maintain their market demand, creating a vibrant environment where diverse genres intersect.

Regional trends and the rise of emerging markets are also noteworthy. This article provides a comprehensive overview of the 2024 art market and explores notable trends and future prospects in detail.

Table of Contents

Overview of the 2024 Art Market

The art market in 2024 is experiencing diverse growth while being influenced by economic conditions and digital technology advancement. Here, we’ll explain in detail the market growth rate, regional trends, and changes brought about by digitalization.

Growth Rate and Economic Impact on the Art Market

The global art market size through 2023 is estimated at approximately $65 billion (9.61 trillion yen).

The 2024 art market is expected to grow, driven by the expansion of the digital art market and new revenue models.

However, economic fluctuations may significantly impact the market.

2024 Edition: Traditional Crafts Market Analysis – Domestic and International Art/Traditional Craft Demand Trends and Digital Impact

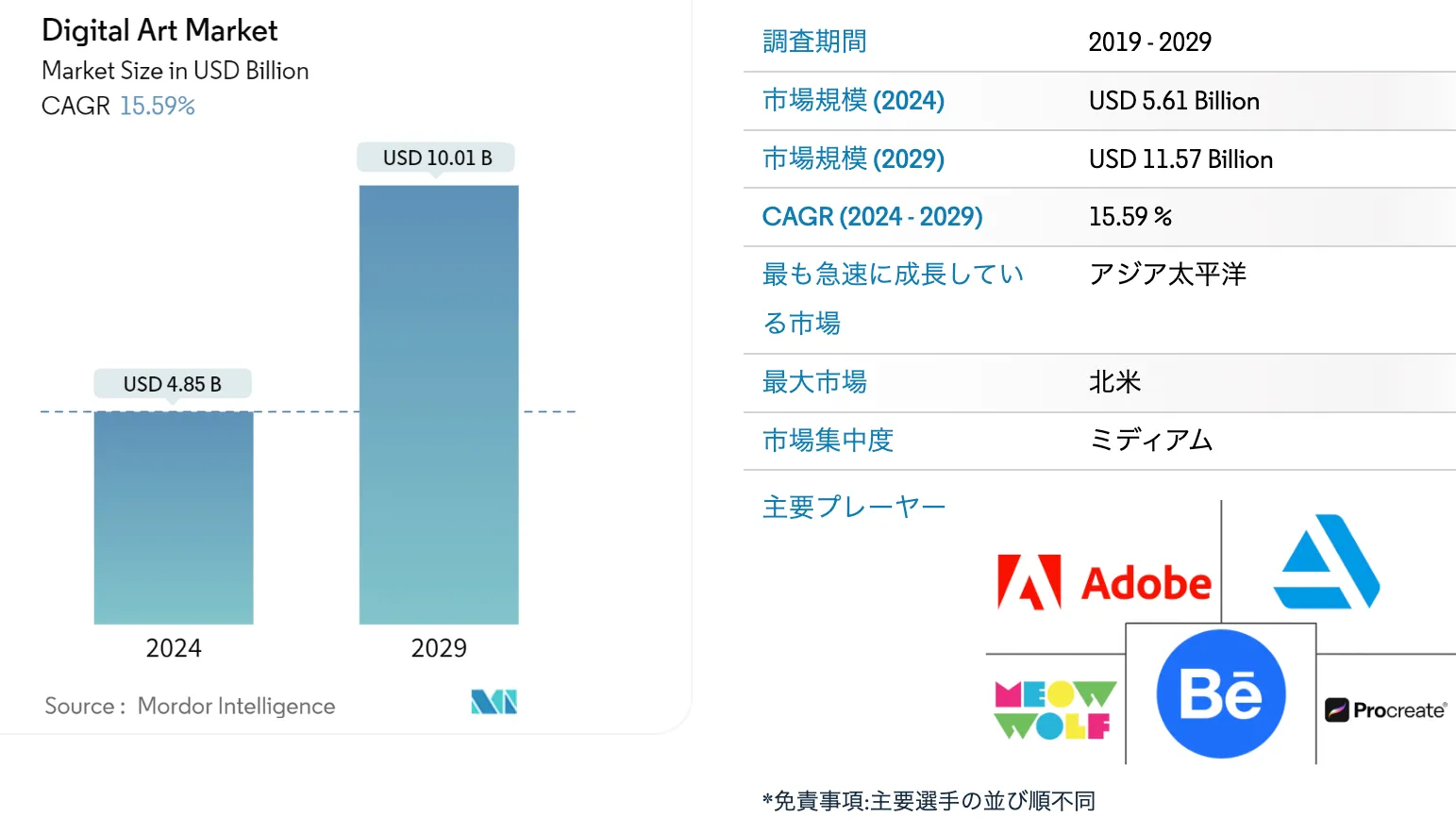

Growth Rate Trends

The digital art market is experiencing rapid growth, with market size expected to reach approximately $4.85 billion (750 billion yen) in 2024 and grow at a compound annual growth rate (CAGR) of 15.59% through 2029. The rise of NFTs (Non-Fungible Tokens) has contributed to this growth, particularly driven by the entry of younger generations and new collectors.

Reference: Digital Art Market Size & Share Analysis – Growth Trends and Forecast (2024-2029) | Market Research Company

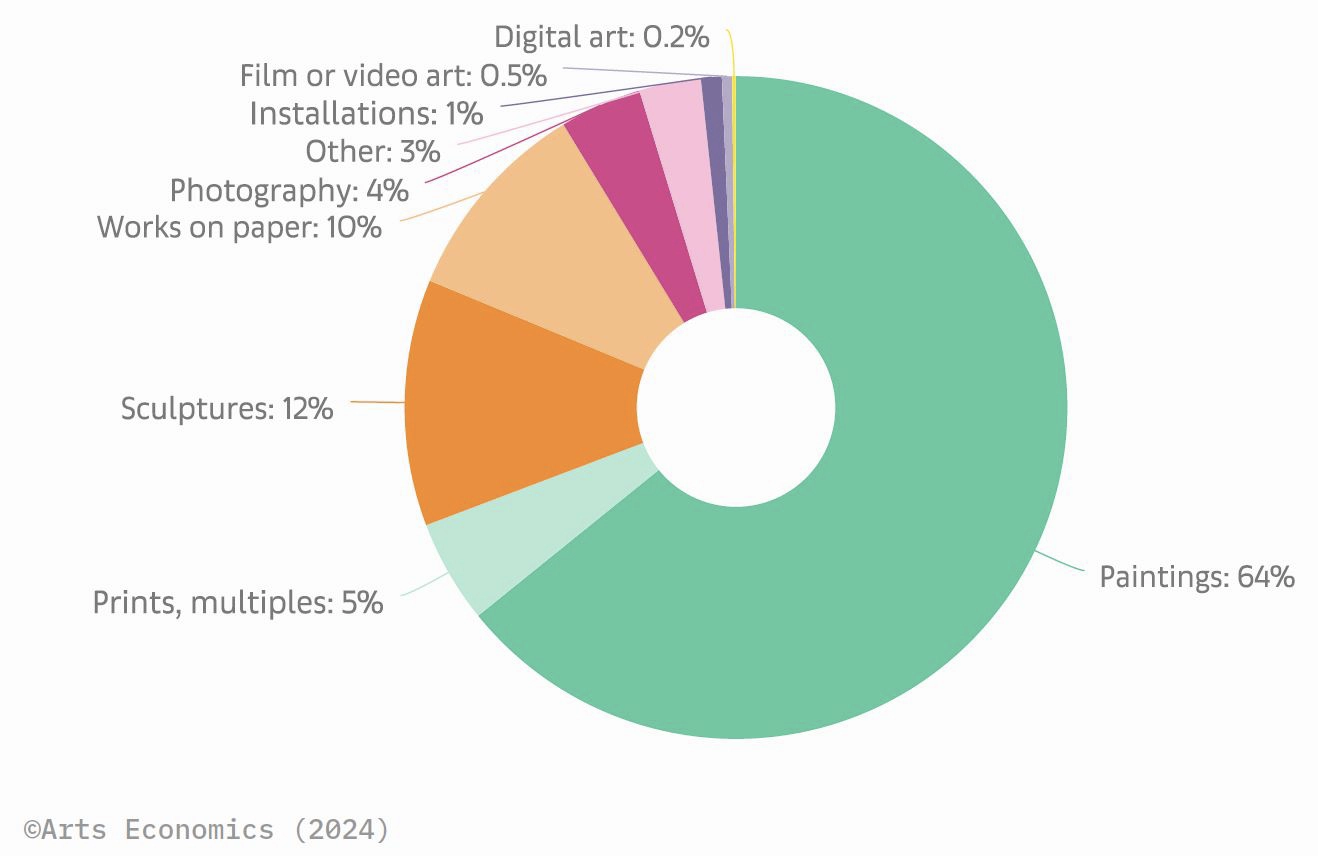

However, digital art accounts for only 0.2% of sales through galleries and dealers in 2023.

Similarly, works exhibited at traditional fairs such as Art Basel remain predominantly physical art.

While the digital art market continues to grow, its presence in the traditional art market remains relatively low.

Economic Impact

Global inflation and fluctuations in monetary policy are factors affecting the art market.

While investors diversify their portfolios by allocating a portion of their assets to art, small and medium-sized galleries and artists may face challenges in an uncertain economic environment.

It’s also noted that economic disparities between regions may create imbalances in market growth.

The art market in 2024 is expected to grow, particularly through digital art and new revenue models, though risks from economic fluctuations exist.

Maintaining market growth will require flexible responses and solutions to regional challenges.

Major Market Trends and Characteristics (America, Europe, and Asia)

The art market forms unique characteristics and trends by region. Below is a summary of major regional trends.

American and European Markets

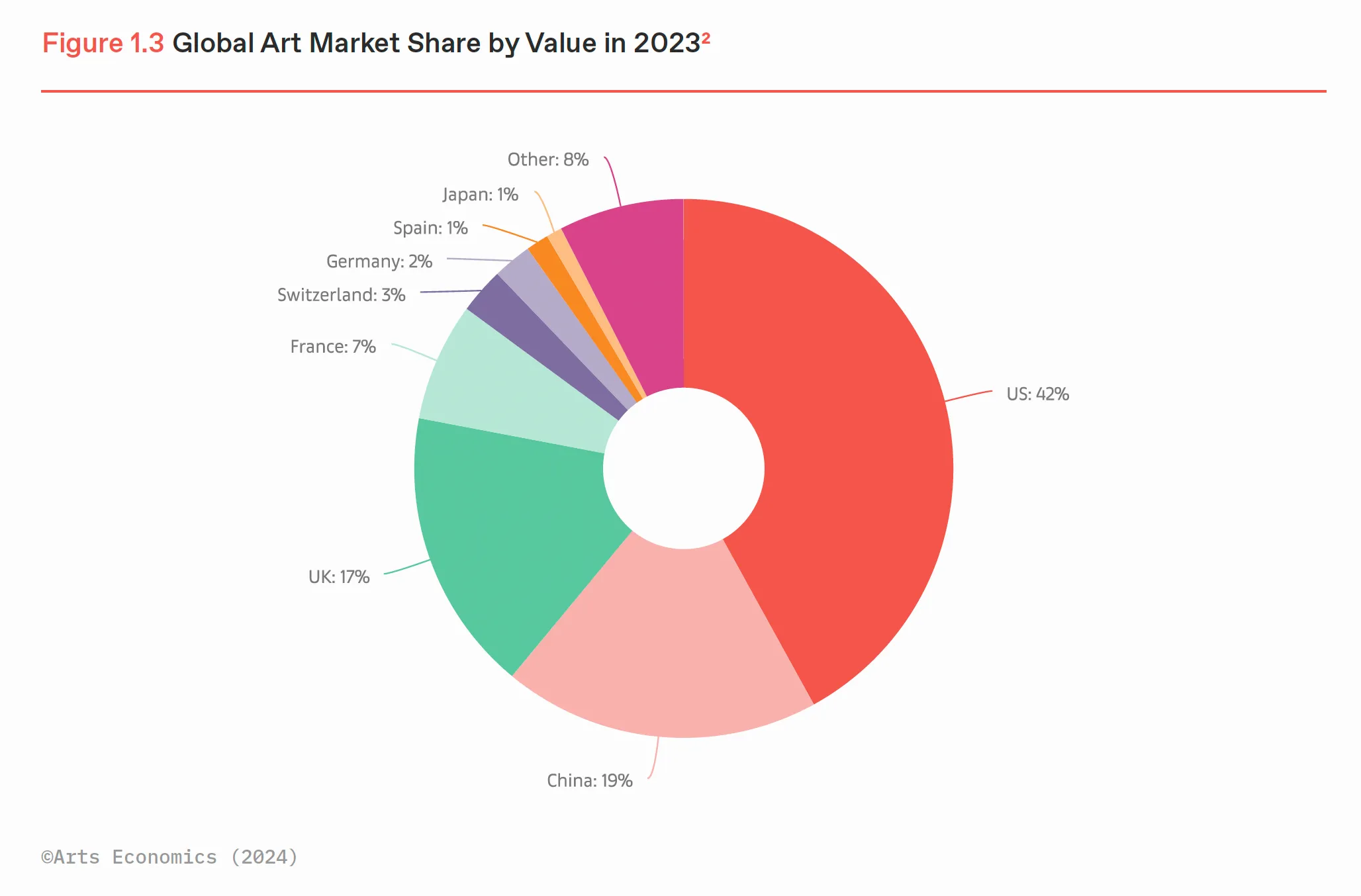

American and European remain the center of the art market, with high-value artwork transactions concentrated in these regions.

Particularly at auction houses in New York and London, works by renowned artists continue to sell at high prices.

However, in 2024, evening auction sales at major auction houses decreased by 33%, indicating challenging market conditions.

Nevertheless, expectations for market recovery have risen following a strong sales season in November.

Asian Market

While China and Hong Kong have established themselves as major art markets in Asia, demand in these regions has decreased due to recent economic challenges and geopolitical uncertainties. This has impacted auction sales in Hong Kong.

Meanwhile, Korea, Taiwan, Japan, and Singapore are emerging as new cultural hubs, with Singapore particularly active in hosting art fairs such as Art SG and S.E.A. Focus, which are energizing the regional art scene.

Reference: 【2025 First Half – Definitive Guide】16 Global Art Fairs: From Art Basel and Frieze to Korea’s New Emerging Fairs

Emerging Markets

Emerging markets in Southeast Asia and the Middle East are showing increased interest in the art market alongside economic growth. The United Arab Emirates (UAE) in particular is experiencing a boom in its art scene with increasing art events and galleries. Southeast Asian countries are also actively hosting regional art fairs, with local artists’ works gaining international attention.

Reference: Sotheby’s Raises $1.53 Billion from Abu Dhabi. Art Basel Also Moving into Abu Dhabi?

These trends indicate that the art market is developing differently in each region, with economic conditions and cultural backgrounds significantly influencing market trends.

Impact of Digitalization on the Art Market

Digitalization continues to bring major changes to the art market in 2024. Here are the key trends:

Growth of Online Sales

The use of online galleries and auctions has increased, allowing collectors worldwide to purchase works beyond physical constraints.

During the pandemic, demand for online auctions rose rapidly, with many auction houses reportedly focusing on online platforms.

Evolution of NFT Art

NFT (Non-Fungible Token) digital art continues to occupy an important segment of the market.

Since Beeple’s work sold for $69 million (approximately 7.5 billion yen) in 2021, the NFT market has experienced rapid growth.

However, in 2024, trading volume and sales numbers have reached their lowest levels since 2020, with market volatility and token price increases identified as challenges.

Utilization of AI and Data Analysis

AI technology advancement is bringing innovation to art creation and market analysis.

AI-enabled artwork creation and personalized recommendations based on collector preference analysis are expanding new possibilities in the art market.

For example, Adobe provides AI-powered creative tools, emphasizing the importance of artists incorporating AI technology.

While these digital advancements contribute to market expansion and diversification, they also present new challenges.

Efforts are needed to ensure market transparency and reliability.

For instance, discussions about AI companies’ impact on the creative industry have intensified, raising concerns about how AI adoption will affect artists’ professions.

Art Genres to Watch in 2024

The 2024 art market sees various genres drawing attention, including contemporary art, classical art, and digital art (NFTs).

Each genre attracts different collectors and investors, bringing unique dynamics to the market.

Here, we’ll explain the demand trends and investment value of each genre.

Contemporary Art Demand and Price Trends

Contemporary art remains central to the art market, attracting many new collectors.

Expanding Demand

Works by emerging artists are gaining attention, with collections starting at affordable prices popular among younger generations. In particular, works themed around gender and social issues maintain high demand with social significance. In the 2023 art market, demand for works by female artists increased, with galleries reporting that inquiries for female artists’ works exceeded inventory levels.

Investment Value of Classical Art and Antiques

Classical art and antique crafts continue to gather strong support as assets with stable value. Here are the key points:

Demand Stability

Classical art, such as Renaissance paintings and Baroque sculptures, maintains strong popularity among collectors and investors due to limited supply and high historical value.

Antique furniture and crafts also see price increases due to their one-of-a-kind rarity.

For example, 18th-century Gujarati embroidery has been revalued at higher than expected prices, highlighting the renewed recognition of historical crafts’ value.

(A case where embroidery purchased by a collector for $10 at an art sale was appraised by experts to be worth $15,000)

Investment Appeal

Classical art and antique crafts are drawing attention as long-term asset preservation tools, offering stable returns compared to other financial assets.

Particularly, works by renowned artists and craftsmen receive high valuations due to their rarity and aesthetic value.

However, careful verification of authenticity and condition is necessary before purchase.

Expert appraisal and purchasing from reliable sources are recommended.

Reevaluation in Emerging Markets

In emerging markets such as the Middle East and Southeast Asia, classical art and antique crafts are gaining support from new collector groups.

This is further activating international trading.

For example, at antique fairs like Spain’s FERIARTE, historically valuable crafts are exhibited and traded, with their value being reassessed as regional cultural heritage.

(Around 70 antique dealers and galleries participate, focusing on Spain’s Golden Age (Siglo de Oro), exhibiting and trading paintings, sculptures, furniture, jewelry, and archaeological artifacts from the 14th century to the present.)

Due to these factors, classical art and antique crafts are positioned as attractive assets combining both cultural and investment value.

Market Trends Art Investors Should Know

In the 2024 art market, environmental consciousness, emerging market growth, and younger generation influence were notable trends.

These changes significantly impact art values and market dynamics, presenting new opportunities and challenges for investors.

Here, we explain the latest market trends investors should know.

Relationship Between Art “Sustainability” and Market Value

Sustainability is gaining attention as an important theme in both the art market and traditional crafts sector. Works using renewable materials and environmentally conscious techniques are increasing, valued as symbols of a sustainable future.

Particularly in traditional crafts like lacquerware and hand-woven textiles, production processes utilizing natural materials are being reevaluated and gaining support from younger collectors.

As traditional crafts merge with contemporary art, works incorporating environmental consciousness become attractive options for companies and individual investors emphasizing social responsibility.

Some auctions and exhibitions see high interest in works with sustainable production backgrounds, creating new value for traditional crafts.

In modern times where environmental issues continue to draw attention, sustainable art and traditional crafts continue developing as important fields combining cultural and market value.

This theme also serves as an opportunity to rediscover the appeal of works closely connected to regional culture and nature, with its importance expected to increase further.

Rapid Growth of Asian Market and Investment Opportunities

The Asian market remains a crucial region supporting overall art market growth in 2024.

Trading is expanding, centered in China, Hong Kong, Japan, and Korea, driven by increasing wealthy populations accompanying economic growth.

While contemporary art and NFTs gather demand, region-specific traditional crafts are also being reevaluated.

For example, works reflecting superior techniques and culture, such as Japanese lacquerware and Chinese ceramics, are considered high-value assets by collectors.

However, while the Asian market is rapidly growing, it also faces risks such as economic fluctuations and regulations.

Careful investment decisions are required while monitoring market trends to address these challenges.

The Asian market, where contemporary art and traditional crafts coexist, draws international attention as a growth sector with diverse appeal.

Risks and Countermeasures in Art Investment

While art investment can yield attractive returns, it comes with risks such as market volatility, authenticity issues, and storage costs.

By properly managing and implementing countermeasures for these risks, art investment can become safer and more effective.

Here’s a detailed explanation of the risks art investors should know and their countermeasures.

How to Manage Art Market Volatility

The art market fluctuates significantly based on economic conditions, trends, and artist evaluations.

Particularly, contemporary art and NFT art experience intense price fluctuations, requiring careful judgment.

Additionally, understanding the economic conditions and cultural background of target investment regions is important as market trends differ by region.

Risk can be reduced by diversifying investments across various genres such as classical art, contemporary art, and digital art, rather than concentrating on a single art genre or artist.

Starting with small investments and gradually expanding the portfolio is an effective strategy.

Art should be viewed as long-term asset building rather than short-term investment returns. Develop plans focused on long-term growth without being swayed by price fluctuations.

Authentication Issues and Points to Avoid Forgeries

When purchasing traditional crafts, consider the following points to ensure reliable transactions:

Choose Reliable Sellers

When purchasing traditional crafts, selecting reliable sellers is crucial. Using established galleries, auction houses, and online platforms can reduce the risk of purchasing forgeries.

For online purchases, verify that seller information is clearly displayed.

Verify Work Certificates

Traditional crafts may come with Certificates of Authenticity verifying their genuineness.

Always verify these during purchase and check document reliability. Traditional crafts may also have certification seals attached, serving as proof of authenticity.

Consult Experts

Consulting experts when considering traditional craft purchases can be effective.

Expert appraisal is particularly useful for verifying authenticity and fair pricing when purchasing expensive or rare items.

Be Cautious of Excessively Low Prices

Traditional crafts priced unusually low compared to market prices may be forgeries or inferior products. Make comprehensive judgments based on work history, transaction records, and seller reliability rather than price alone.

For online purchases, it’s important to verify detailed product descriptions, images, and high seller ratings.

Consider these points to make traditional craft purchases safe and satisfying.

Plan Investments Considering Storage and Maintenance Costs

To maintain traditional crafts in beautiful condition for long periods, appropriate storage environments and consideration of maintenance costs are important. Here are the main points:

Establish Proper Storage Environment

Traditional crafts are sensitive to humidity, temperature, and light, with paintings and paper works particularly susceptible to deterioration, making storage environment management crucial. Use specialized framing and storage cases to maintain work value long-term.

Also, avoiding direct sunlight and maintaining appropriate humidity and temperature helps prevent deterioration.

Include Maintenance Costs in Budget

Storing traditional crafts requires framing costs, dedicated storage space rental fees, and insurance premiums.

It’s important to incorporate these maintenance costs into investment plans. Consider specialized insurance for high-value works to protect against damage or theft.

Exhibition Considerations

When displaying works at home or in galleries, choose locations away from direct sunlight and moisture.

UV-protective glass framing is also effective. Learn proper handling methods and avoid direct contact with works.

These measures can help maintain the beauty and value of traditional crafts long-term, contributing to investment value preservation.

Conclusion

The 2024 art market is expanding new possibilities through digital technology evolution, emerging market growth, and the rise of younger generations.

Various genres, including contemporary art, digital art (NFTs), and the reevaluation of classical art, are energizing the market, creating attractive opportunities for investors and collectors.

Particularly, the expansion of online platforms and AI technology utilization has revolutionized art purchasing and value creation, revealing new market forms beyond physical constraints.

However, it’s also important to properly manage risks such as authenticity issues, storage costs, and market volatility.

Investing in artwork not only provides economic investment but also brings cultural value that enriches the spirit.

While monitoring market trends, finding works and artists that truly bring personal enjoyment represents the greatest appeal of art investment.