In 2025, the craft market is attracting global attention, with demand increasing particularly among consumers who value individuality and cultural significance.

Various genres, including woodworking, metalwork, embroidery, and ceramics, form this market, each captivating consumers with their unique appeal.

This article provides a detailed analysis of the latest craft market trends by genre, distribution channels, and from the perspective of overseas markets.

Table of Contents

Looking Back at the Global Art Market in 2024 | “The Art Basel and UBS Global Art Market Report 2025”

The main factor behind this sales decline was the contraction of the high-value art market. While the number of transactions remained stable, multi-million dollar high-value transactions decreased, significantly impacting total sales. However, lower-priced transactions remained steady, indicating underlying strength in the overall art market.

The background factors include geopolitical tensions, economic instability, high interest rates, and inflation. In 2024, many consumers became more price-sensitive and tended to curb spending on expensive non-essential items. The art market was no exception, with particular caution observed in high-end purchasing activities. Additionally, social and political uncertainties due to elections in major countries created a “wait-and-see” mood in the market, causing a shortage in the supply of high-value works.

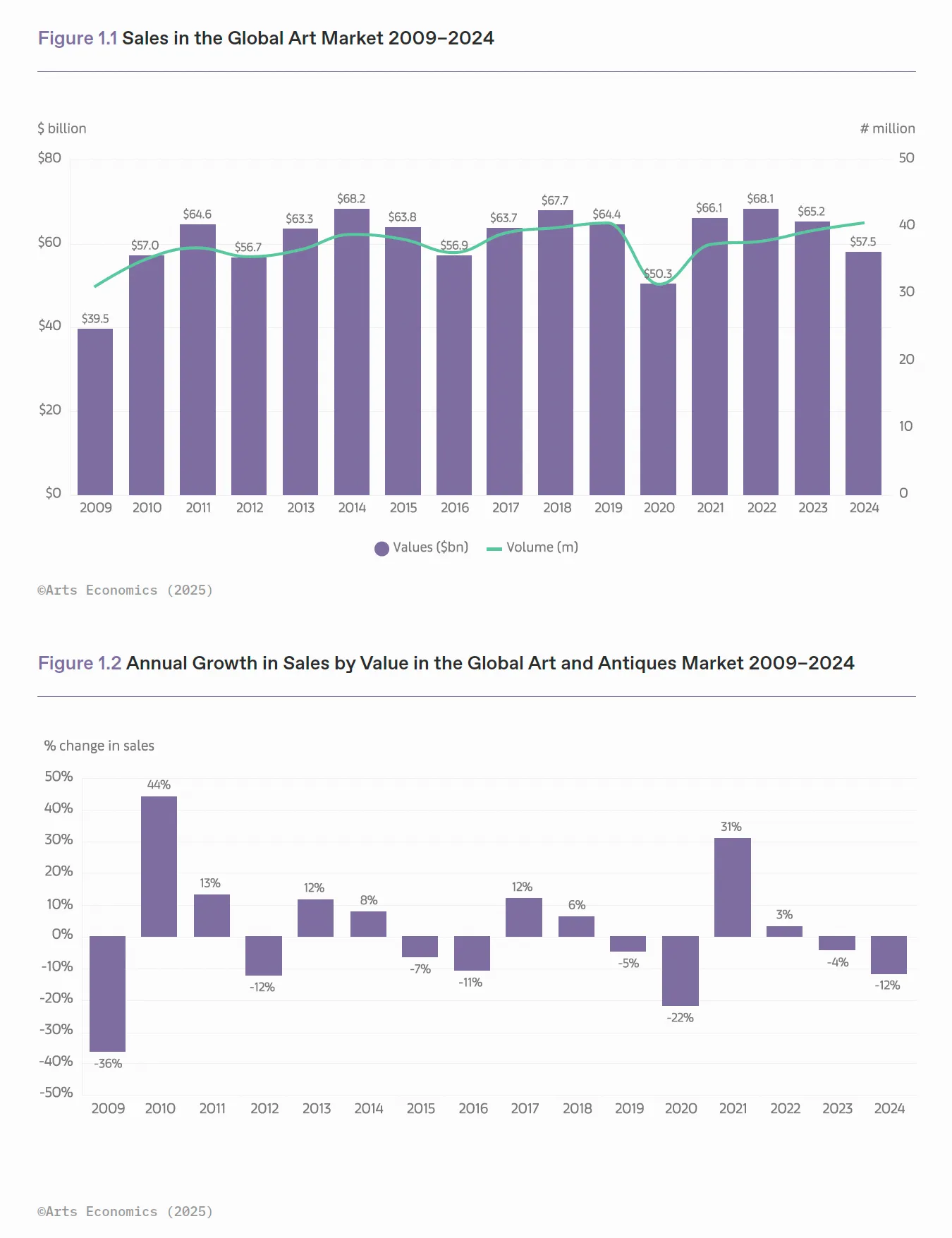

Looking back over recent years, the market size decreased by 22% in 2020 due to the COVID-19 pandemic, falling to $50.3 billion. However, in 2021, with the revival of live events and exhibitions, supported by pent-up demand, it recovered significantly to $66.1 billion. In 2022, it reached $68.1 billion, far exceeding pre-pandemic levels. But from 2023, growth slowed due to the deceleration in the high-value market, with a further significant decrease seen in 2024.

On the other hand, looking at transaction numbers, there was a 3% increase in 2024, reaching 40.5 million transactions. This growth was supported by the acceleration of digital transactions and an expansion in more affordable price ranges.

Another interesting trend was the strong performance of private sales by auction houses. In 2024, private sales recorded a 14% growth compared to the previous year. In an uncertain market environment, non-public transactions, which allow better control over prices and schedules, seemed to be preferred.

As of the end of 2024, the market composition consisted of 41% auctions (both public and private) and 59% transactions by dealers and galleries. The future market trends will likely be determined by how the recovery of the high-end market and the vibrancy of the lower price range segments balance each other.

What’s Next for the Art Market in 2025? Latest Outlook Summary | The Art Basel and UBS Global Art Market Report 2025

The art market in 2024 was shrouded in uncertainty. Concerns about conflicts in Ukraine and the Middle East, as well as elections in the US and Europe, spread a cautious mood throughout the market. In particular, the buying and selling of high-value works cooled for the second consecutive year, with both sellers and buyers taking a wait-and-see approach in many cases.

While some uncertainties have been resolved, future economic policies, especially trade policies, pose new risks. Changes in trade policies could impact economic factors such as inflation, interest rates, and exchange rates, potentially affecting the art market as well.

Meanwhile, global economic growth remains relatively stable. According to IMF forecasts, world GDP growth is expected to be 3.3% in 2024 and 3.4% in both 2025 and 2026. Although slightly lower than pre-COVID levels (2000-2019 average of 3.7%), steady growth is expected to continue.

Inflation, which rose to 8.6% in 2022, decreased to 5.8% in 2024. It is projected to further decline to 4.2% in 2025 and 3.5% in 2026. As inflation stabilizes and interest rates fall, art purchases by the wealthy may become more active, potentially providing a tailwind for the market.

However, concerns about the rise of protectionism and economic nationalism remain. The contemporary art market has been supported by a free trading environment that transcends borders. Excessive trade regulations could reduce international transactions and slow market growth.

The background to America and Britain’s leadership in the art market includes not only their strong economic power but also their transparent legal and tax systems. These environments have promoted art circulation from both domestic and international sources. Conversely, countries that have imposed heavy regulations have seen growth in their domestic markets suppressed.

For the art market in 2025, while there are positive factors such as global economic recovery and stabilizing inflation, how the market responds to risks related to politics and trade will be a significant key.

How Large is the Craft Market Size in 2025?

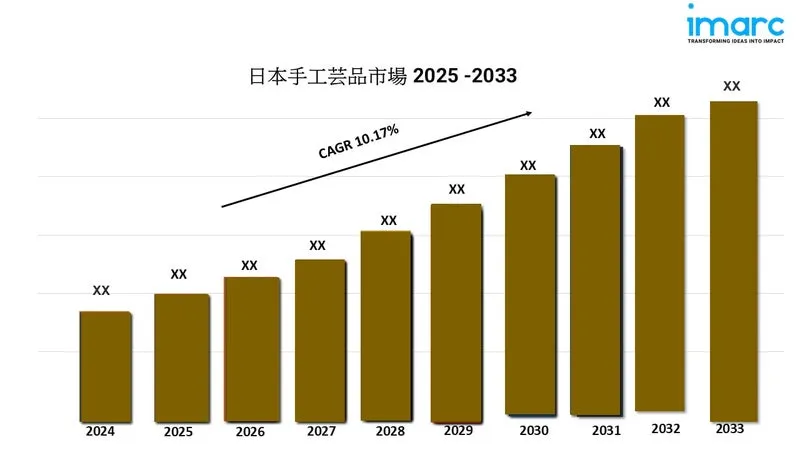

The craft market in 2025 is expected to see further growth, driven by diversifying cultural values and increasing consumer needs for individuality. Technological innovation and growing interest in sustainability are also bringing new dynamics to the market.

Here, we will organize past market trends and market definitions while explaining the market size and key points for 2025 in detail, focusing on changes from 2024.

Latest Domestic Market Data and Year-on-Year Trends

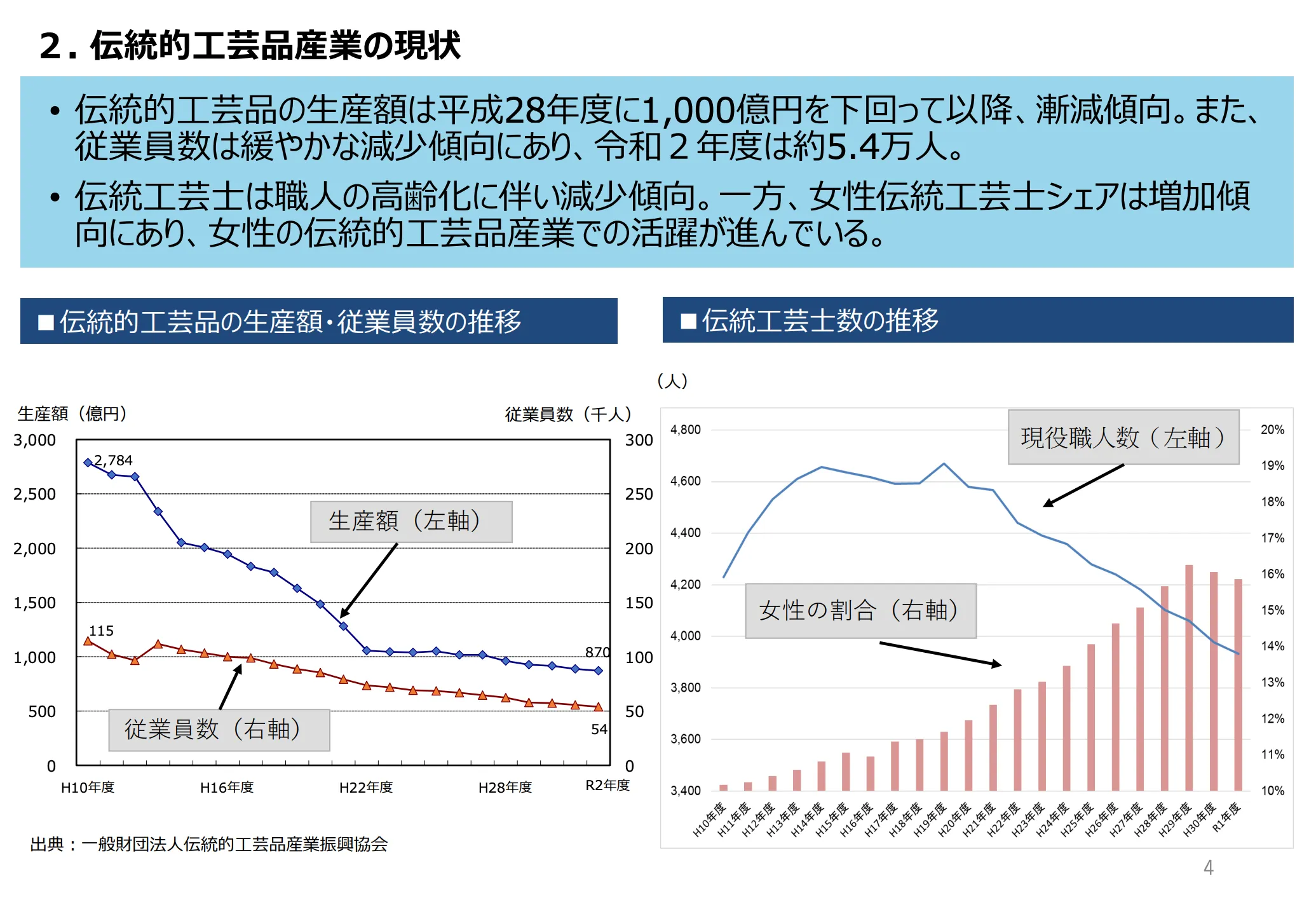

The production value of traditional craft industries overseen by the Ministry of Economy, Trade and Industry peaked at 540 billion yen (approximately 0.54 trillion yen) in 1983 and has followed a long-term declining trend, shrinking to about 102 billion yen (approximately 0.1 trillion yen) by 2015. As of 2016, it was about 96 billion yen, less than one-fifth of its peak, clearly showing the shrinking domestic craft market.

In fact, there are observations that “the shrinking of Japan’s craft market is unavoidable,” and it cannot be said that a stable annual growth of 5% has continued in recent years.

However, 2023 marked a recovery period from the decline caused by COVID-19, with signs of demand recovery in some areas due to the rapid increase in visitors to Japan (about five times the previous year). In particular, interest in Japanese crafts from wealthy segments, especially from China, has been growing, and an increase in overseas demand has also been reported.

Keys to Future Growth: “Digital” and “Innovation”

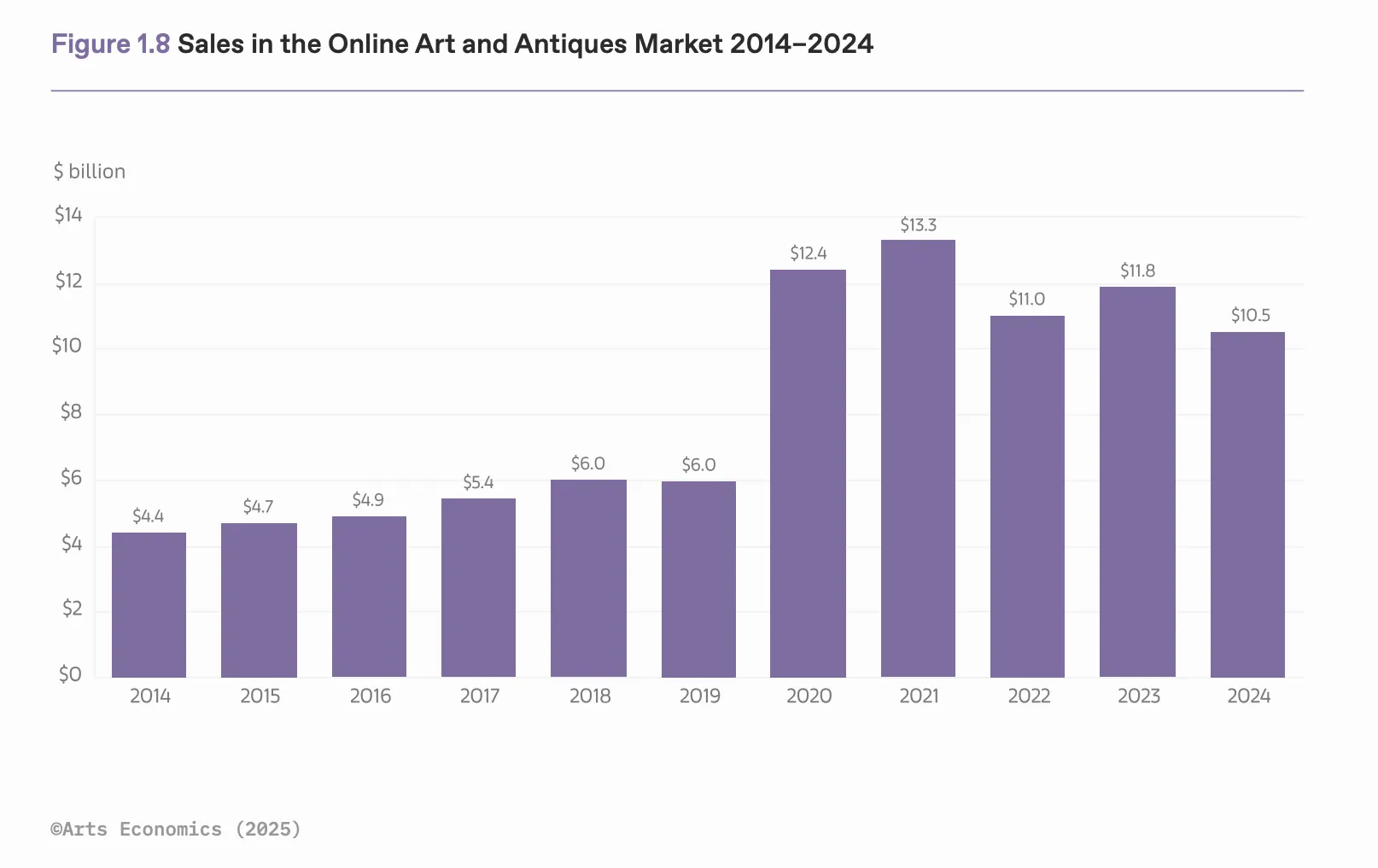

Meanwhile, in the art market, the share of online-only sales increased significantly from 9% to 25% as the art industry thoroughly developed its digital infrastructure. Global retail e-commerce has stabilized at about 20% of total retail sales over the past two years, but future growth forecasts have been significantly revised downward, predicted to reach 23% by 2027.

While the e-commerce sales share in the art market remains at a high level, it still represents a minority in monetary terms due to the persistent differences in dominant price ranges across channels.

Both dealers and auction houses are focusing on improving the convenience of e-commerce.

The key to actual market expansion lies not in rapid growth but in stimulating demand through digital technology utilization and product innovation. In recent years, artisans have been expanding their sales channels by utilizing EC sites and online marketplaces, and new initiatives such as using blockchain technology to guarantee the authenticity of works have also begun.

Public institutions are also paying attention to these trends, and there is potential for new market opportunities depending on marketing and product strategies. Therefore, the biggest challenges currently are boosting the domestic market and developing overseas demand.

Current Status of Craft Production Areas and Supporting Artisans

The key players in this market are small and medium-sized businesses and sole proprietors rooted in their regions, with many being artisans inheriting traditional techniques. Statistically, there are many small-scale manufacturers, with about 300 craft production areas existing in Japan.

However, as mentioned earlier, the domestic market for traditional crafts as a whole is trending downward. Therefore, there is no statistical evidence to firmly state that “further market expansion is expected in 2025.”

Currently, while diversification is progressing through the acquisition of niche overseas demand and fusion with art and interior fields, there are still challenges before the overall market size can grow significantly. Public institution reports also point out structural problems such as a shortage of successors and sluggish domestic demand.

At the same time, it is also true that efforts to find a way forward are becoming more active in various regions by strengthening design capabilities and developing new customer segments.

Changes from 2024 and Notable Points

From 2024 to 2025, the craft market is characterized by increasing sustainable orientations and expanding digital sales. Interest in environmentally conscious materials and techniques, as well as high-quality products that can be used for a long time, is spreading, especially among younger generations, and the Patent Office is also paying attention to these trends.

Companies and artisans are also beginning sustainable initiatives such as utilizing natural materials, recycling waste materials, and implementing carbon-neutral manufacturing processes. Concrete movements like furniture made from thinned wood and dyeing with natural dyes are already underway.

Utilization of Online Sales and Cross-Border E-Commerce

The importance of online sales has increased after the COVID-19 pandemic. Digital shifts have penetrated the craft industry, including official EC sites, major malls, and promotions using SNS. In 2024, sales through online channels increased, changing the channel composition.

Cross-border EC and Instagram marketing are also effective means of accessing niche markets overseas. Public support is also progressing, with developments such as online exhibitions and digitization of production area information.

Glocal Strategies and Qualitative Market Changes

Movements connecting global and local (glocal), such as overseas expansion through the fusion of traditional crafts and contemporary design, and local governments’ participation in international trade fairs, are also becoming active. The Ministry of Economy, Trade and Industry reports that regional culture and technology are being evaluated as a “new luxury.”

While the market is changing in this way, it is at a stage where attention should be paid to qualitative changes rather than quantitative expansion. The key to growth in the craft market is the construction of sustainable business models, including environmental consideration, digital adaptation, and branding that leverages the storytelling of the region.

Market Size and Trends by Craft Genre

The craft market is gaining attention worldwide for its diversity and cultural value. Understanding market size and growth trends is essential for grasping industry developments and making strategic decisions. This article analyzes in detail the current market size and recent growth trends for each major craft genre, such as ceramics, woodworking, and metalwork. This will help evaluate the commercial potential of each craft and optimize future market expansion strategies. We will also touch on regional demand differences and the impact of digitalization to reveal the overall picture of the craft market.

Ceramics Market Size and Trends by Production Region

The ceramics market has been expanding in recent years. According to one market research, the global porcelain market size is expected to reach about $9.9 billion in 2024 and about $15.6 billion by 2032, with an average annual growth rate of about 6%. In terms of production, Asia is the center, with China boasting overwhelming production volume, while Japan and Korea also demonstrate their presence with high-quality products.

Reference: Porcelain Market Size, Share, and Industry Analysis | Fortune Business Insights

In the Western tableware field, production bases have shifted to China, Korea, and Southeast Asia due to cost and production efficiency considerations, and major Japanese manufacturers have also shifted to overseas production. Recently, countries such as Thailand, Vietnam, and India have also emerged as new production bases, further intensifying international competition.

Meanwhile, consumer preferences have also diversified. In addition to the layer that values the cultural value of traditional ceramics, the layer seeking modern and original designs is also expanding. In response, each manufacturer is developing a wide range of products from traditional designs to contemporary designs.

Furthermore, with the penetration of SDGs, eco-consciousness is also increasing, and sustainable manufacturing is being promoted, such as the use of recycled materials and the introduction of manufacturing methods with low environmental impact. Attention to environmentally conscious ceramic products is also increasing, and it has been pointed out that this is bringing back new interest in traditional crafts.

Reference: Latest Technological Trends and Future Prospects in Ceramics

Growth Rates by Category: Lacquerware, Woodworking, Dyeing and Weaving, etc.

Since public growth rate data for craft categories such as lacquerware, woodworking, and dyeing and weaving are scarce, here we present qualitative trends.

Lacquerware (Lacquer Crafts)

Lacquerware (lacquer crafts) has seen a long-term decline in production value; for example, Wajima-nuri’s production value decreased from about 18 billion yen in 1991 to about 2 billion yen in 2023. However, there are signs of demand recovery in some areas due to the recovery of inbound tourism and the use of online sales. Production areas are also acquiring new customers through EC to meet the needs of visitors to Japan who want souvenirs and those who want to purchase fragile lacquerware online. Product development that maintains tradition while enhancing practicality and design is also progressing, and efforts are being made to strengthen competitiveness in niche markets.

Woodworking (Wood Crafts)

For woodworking (wood crafts), interest in natural material products is increasing against the backdrop of growing sustainable orientations in North America and Europe. Japanese wood products, in particular, are attracting attention for their durability and environmental friendliness, and handling by overseas buyers has increased in recent years. Although the market size is limited, there is stable demand from those who aspire to sustainable lifestyles.

Textile Arts (Traditional Weaving and Dyeing)

In the field of textile arts (traditional weaving and dyeing), while domestic demand is declining, the development of new products that fuse traditional techniques and contemporary design is progressing. There are also cases where established manufacturers develop clothing for Western-style wear and expand overseas, and textiles and fashion accessories using Japanese dyeing and weaving techniques are being supported by young people and the wealthy in Asia. Products that combine traditional kasuri patterns and dyeing methods with contemporary designs offer freshness and a sense of luxury, gaining niche popularity.

Thus, each field of lacquerware, woodworking, and textile arts is developing products and expanding sales channels in response to their respective market needs, against the backdrop of changes in consumer lifestyles and international cultural exchanges. While the production value of traditional crafts as a whole continues to decrease, there are also production areas that are achieving growth through new developments and entry into overseas markets. Efforts by each field to enhance competitiveness in niche markets are considered to lead to the revitalization of the industry as a whole.

Growing Demand as Contemporary Crafts and Art Pieces

“LOEWE CRAFT PRIZE 2018” Takuro Kuwata Special Prize

In recent years, there has been a growing movement both domestically and internationally to view crafts as contemporary art, and demand has also expanded. With the increase in consumers who value sustainability and individuality, handmade one-of-a-kind pieces and highly unique works are attracting attention. Overseas, the “craftsmanship,” “unique design,” and “cultural value” of Japanese crafts are highly evaluated, and their storytelling, which cannot be found in mass-produced products, is supported in the premium market.

In fact, there are increasing examples of crafts being traded at high prices as art pieces, and exhibition opportunities at galleries and art fairs are also expanding. At a London exhibition event, lacquerware and Japanese-patterned crafts were popular, with purchase requests also seen. Moves to purchase directly from overseas online are also becoming active, making it easier to approach art-oriented customer segments.

These trends are boosting the value enhancement and market expansion of crafts, and the Japanese government and related organizations are also strengthening the promotion of crafts as art and supporting exports. In particular, works by young artists with new sensibilities are attracting attention, and works that fuse traditional techniques with contemporary design and pop culture are gaining support from younger generations and overseas collectors.

With these trends, the image of Japanese crafts is shifting from “old daily items” to “contemporary art,” and the market base is steadily expanding.

Inbound Demand and Overseas Export Trends

Inbound demand and overseas exports are indispensable pillars of the Japanese economy. The increase in foreign visitors brings direct benefits to the tourism industry and regional economies, and overseas exports create new opportunities for market expansion in fields such as manufacturing and crafts.

As globalization progresses, understanding how these two flows interact and spread through the economy is important for the strategic planning of companies and local governments. Here, we focus on the purchasing trends of visitors to Japan, export trends, and branding strategies for Japanese crafts that are valued worldwide, examining the latest movements in detail.

Purchase Trends and Popular Items Among Visitors to Japan

There are characteristics in purchasing trends of foreign visitors to Japan by country and region. According to a survey by the Japan Tourism Agency, travelers from East Asia such as China and Korea often purchase Japanese cosmetics and pharmaceuticals, with about 52% of Chinese travelers purchasing cosmetics and perfumes.

On the other hand, travelers from Europe and America have a high interest in Japanese culture, with about 18.5% of American visitors purchasing folk crafts and traditional crafts. This is significantly higher than Chinese travelers (about 6.9%). Therefore, the trend that “East Asia is interested in cosmetics” and “the West is interested in traditional crafts and anime goods” is consistent with statistics.

Overall, the items with the highest purchase rate are food souvenirs (about 72.6%), followed by cosmetics. The purchase rate for traditional crafts is less than 10%, but they are relatively popular among tourists from Europe and America.

Japanese companies are strengthening their efforts to capture inbound demand by differentiating their product strategies according to such country-specific preferences. These analyses are also being utilized for future overseas expansion strategies.

Japanese Crafts Attracting Global Attention and Branding Strategies

Efforts are needed not only to preserve tradition but also to add design and storytelling suitable for contemporary lifestyles. The government, local authorities, and JETRO are also supporting efforts to strengthen brand power through participation in overseas trade fairs and market research support.

The point that “high quality and uniqueness are evaluated, and brand value enhancement is possible” mentioned in the description is reasonable, but this alone is insufficient, and product planning and marketing that match local preferences are necessary. Therefore, strategies such as branding that emphasizes production area names and craftsmanship, as well as design renewal, are being pursued.

It is expected that through such brand strengthening and overseas expansion support measures, Japanese crafts will enhance their competitiveness in the international market, leading to sustainable growth.

Conclusion

The Japanese craft market, while facing challenges such as declining domestic demand, is showing signs of new developments against the backdrop of sustainable orientation, digitalization, and growing international cultural interest. In each field, product development and sales channel expansion adapted to modern lifestyles and overseas markets are being pursued while inheriting traditional techniques, and contemporary craft works by young artists are also being evaluated in the art market.

On the other hand, Japanese traditional crafts are not sufficiently recognized as international brands, and strengthening branding and accurate marketing strategies are essential for future growth. Efforts such as product development based on the preferences of visitors to Japan by country, utilization of online sales, and establishment of production area brands are the keys to supporting the sustainable development of the craft industry.

By fusing tradition and innovation and responding to diverse needs both domestically and internationally, Japanese crafts have the potential to continue increasing their value not only as cultural assets but also as competitive industries in the international market.

![[Comprehensive Analysis] Latest Data and Growth Strategies for the 2025 Craft Market | Explaining by Genre, Distribution Channels, and Overseas Demands [Comprehensive Analysis] Latest Data and Growth Strategies for the 2025 Craft Market | Explaining by Genre, Distribution Channels, and Overseas Demands](https://en.kogei-japonica.com/media/wp-content/uploads/2025/04/crafts-market-2025_7-1024x576.webp)