Japanese craft is highly valued overseas not only for its meticulous attention to materials and advanced techniques, but also for its unique value system of “functional beauty” (yō no bi), which aligns well with the international design market.

Lacquerware, woodwork, ceramics, and textiles are recognized as bridging art and living culture, establishing a solid market position as independent categories in Western galleries and art fairs.

However, challenges such as a shortage of successors and weak international communication have been pointed out, making it important to understand the future outlook.

This article comprehensively explains popular genres overseas, the required artistic qualities, and perspectives necessary for market expansion.

Table of Contents

What is the Demand for Craft and Art Overseas? An Overview of the Global Market

Demand for craft and art in overseas markets has a multi-layered structure where “art markets,” “craft/design markets,” and “luxury & lifestyle markets” overlap. In the fine art world centered on auctions and galleries, evaluation of “three-dimensional works originating from craft” is growing alongside contemporary art.

Meanwhile, in the lifestyle sector, “one-of-a-kind nature,” “handwork,” and “sustainable materials” are emphasized as differentiation axes from mass-produced products, and demand for craft-oriented products is gradually expanding. Here, we organize the overall picture of craft and art demand overseas from three perspectives: market scale and growth trends, positioning in luxury/lifestyle contexts, and fundamental differences from mass-produced goods.

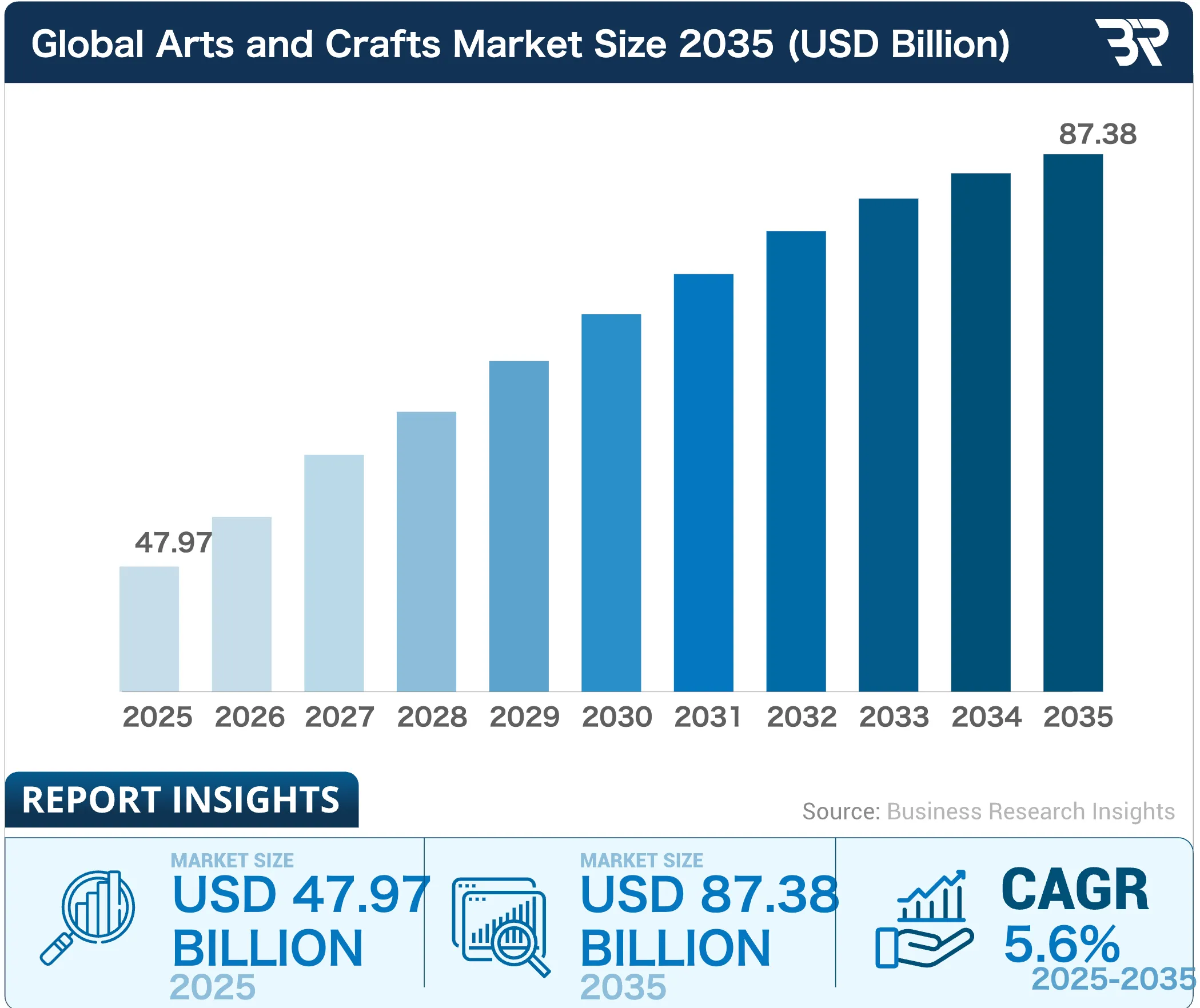

Global Arts & Crafts Market Scale and Growth Trends

Business Research Insights

Particularly notable growth is seen in:

- Direct sales and semi-custom orders through online platforms

- Collaboration with architecture and interior fields

- Material-oriented design in sustainability contexts

Additionally, younger collector demographics have a stronger orientation toward “enjoying works as part of living spaces,” expanding demand for relatively affordable objects such as craft vessels, lighting, and small sculptures. In other words, craft items are growing as a market in the medium to long term not just as “investment targets” but as “objects expressing life and values.”

Positioning in Luxury and Lifestyle Markets

In luxury retail, handcraft elements such as ceramics, lacquer, and metalwork are incorporated into store fixtures, objects, and furniture parts, serving as important pieces to express “brand identity” at the spatial level.

Meanwhile, in the general lifestyle market, at the middle to high-end range, “slightly expensive but long-lasting/meaningful items” are supported, with stable demand for craft vessels, cutlery, and textiles. Thus, craft items serve different roles: in high-end contexts as “the face of the brand,” and in general markets as “items that enhance the quality and story of life.”

Differences from Mass-Produced Products: Evaluation Criteria of “One-of-a-Kind” and “Story”

The primary reason craft items are valued in global markets is their “uniqueness” and “story,” which are difficult to replicate with mass-produced products. Mass-produced goods have uniform quality and controlled prices, but this makes it harder to see “by whose hands and under what circumstances they were created.”

In contrast, craft items connect the artist’s name, regional history, lineage of techniques, and material origins, giving each piece its own unique narrative. This narrative quality is recognized as “authenticity” and resonates particularly strongly with overseas collectors and design-savvy demographics.

Furthermore, fine finishing, hand traces, and the randomness from firing or hand-dyeing hold value as “unreproducible details.” While they may be inferior to mass-produced goods in price alone, craft items as “objects expressing one’s values” and “objects that can be passed down across generations” are steadily establishing their own position in global markets. For craft businesses, the key lies in how to verbalize this “one-of-a-kind nature and storytelling” and incorporate it into presentation methods.

Regional Demand Structures

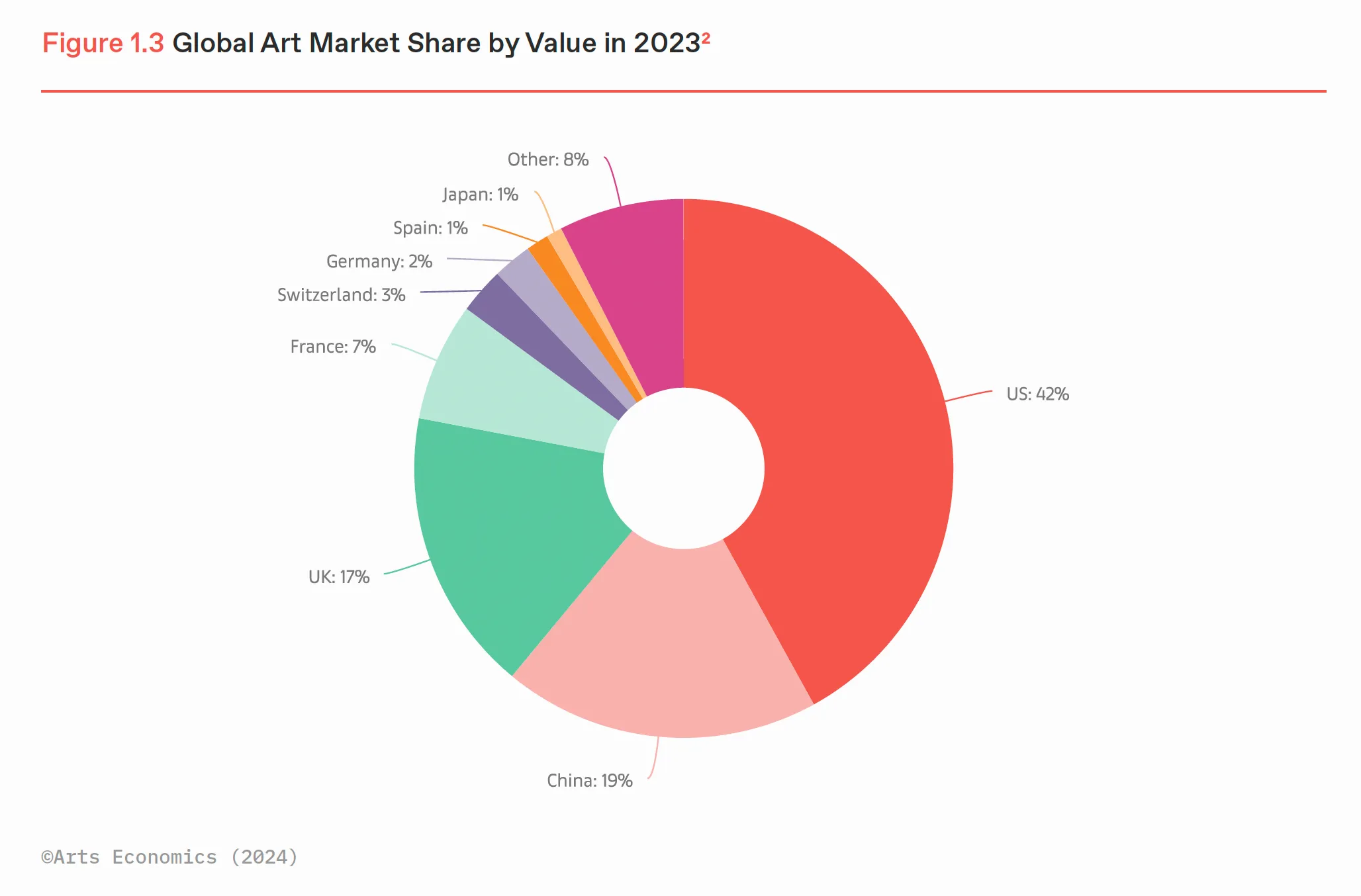

Meanwhile, emerging Asian markets see “hybrid buying patterns” crossing art, design, and craft as wealth formation among the affluent connects with lifestyle orientations. Here, we organize the characteristics of North America, Europe, and major Asian regions, clarifying what positioning should be taken when delivering craft.

North American Market: Characteristics of Collectors, Museums, and Galleries

The North American market, particularly the United States, is a “story-oriented” market originating from museums, university institutions, and top galleries. Wealthy collectors judge purchases not only on the beauty of individual works but by strongly considering the artist’s background, connections to gender, ethnicity, and social themes, and curatorial context, with various studies showing that younger collectors and women tend toward collection formation connected to “identity,” “community,” and “purpose.”

Against this background, even for craft works, it becomes important to verbalize in English “why this material” and “what culture and history it carries.” Additionally, museum shops, craft fairs, and design-focused online platforms are well-established, creating a “stepped lineup” across a wide price range.

Entry-level buyers purchase vessels and small objects in the several hundred dollar range, mid-level collectors invest in one-of-a-kind pieces at several thousand dollars and above, and top collectors often invest in large-scale sculptures and installations through galleries, forming a tiered market structure. To succeed in North America, it is virtually essential to prepare not just the work itself but a complete package of “artist statement,” “production process photos and videos,” and “continuous communication in English.”

European Market: Mature Market Where Craft and Fine Art Boundaries are Thin

A major characteristic of the European market is that craft and art have historically been in close proximity. In fields such as ceramics, glass, textiles, and woodwork, national museums and design museums have systematically collected and exhibited works since the 19th-20th centuries, fostering sensibilities that evaluate works without drawing lines based on “because it’s craft” or “because it’s art.”

Therefore, it is also a market where “relying on materials” is not sufficient, in a good sense. The completeness of form, relationship to space, and strength of concept are strictly evaluated, making differentiation difficult based solely on maintaining traditional techniques.

On the other hand, long-term collection orientations are strong, with tendencies to value an artist’s career and archival accumulation, so artists with continuous activities and well-organized documentation tend to be more trusted. In Europe, craft is simultaneously “tools for living” and “art carrying culture,” and positioning based on this duality becomes important.

Emerging Asian Markets: Demand from Affluent Demographics in China, Korea, Singapore, etc.

In emerging Asian markets, centered on mainland China, Korea, Singapore, and Hong Kong, distinctive craft demand has emerged where wealth formation among the affluent connects with lifestyle orientations. What is characteristic is that “art investment” and “ownership as lifestyle” are on the same table.

There are many cases where ceramics, lacquer, metalwork, and glass works are introduced collectively for penthouses and luxury hotel lounges, with strong demand for craft that can be discussed in conjunction with architecture and interior design. In Korea, alongside the rise of domestic contemporary craft, interest in craft from neighboring countries including Japan is high, with increasing international joint exhibitions at design and craft fairs.

Singapore and Hong Kong function as “Asian art hubs” due to tax advantages and logistical convenience, with even small objects and vessels sometimes traded at high-end price points. When targeting emerging Asian markets, being conscious of these three points makes it easier to connect with affluent demand: “collaboration with high-end real estate and hotels,” “gallery-mediated exhibitions,” and “brand story dissemination using SNS/video.”

Popularity Trends by Category and Material

Overseas craft demand changes results as much by “what material, for what purpose” as by “which country.” Ceramics, glass, and metalwork tend to be evaluated in the context of tableware and interior design, while textiles, dyeing/weaving, and paper are evaluated in fashion and spatial staging contexts.

Meanwhile, mixed media combining multiple materials and contemporary craft are emerging as “art-leaning entities” at art and design fairs. Here, we organize by material “in what situations they are easily selected” and “what presentation methods are compatible,” summarizing in forms that can be easily applied to actual projects and product development.

Ceramics, Glass, Metalwork: Demand as Interior & Tableware

Ceramics, glass, and metalwork are first received overseas through the two pillars of “tableware” and “interior objects.” Ceramics are valued for both their utility as vessels and sculptural forms, with stable demand not only for tableware but also for vases, objects, and wall pieces.

Glass, with its compatibility with light, is easily selected as “objects containing light” such as objects placed in hotel lobbies or residential window areas, and lighting fixture shades. Metalwork often begins with small items around tables such as cutlery, trays, and candlesticks, expanding from there to large objects and wall panels.

For all these materials, being conscious not just of “beautiful vessels” but of size variations, series coherence, and spatial balance when placed makes them more likely to be adopted by overseas galleries and interior projects.

Textiles, Dyeing/Weaving, Paper: Linkage with Fashion and Spatial Staging

Textiles, dyeing/weaving, and paper are fields often evaluated not just as standalone “works” but through linkage with fashion and spatial staging. Textiles and dyeing/weaving are easily adopted in collaborations with stoles, bags, and apparel, or as curtains, cushions, and wall hangings in hotels and restaurants, positioned as “craft that softly colors living spaces.”

Color variations and pattern fluctuations unique to hand-dyeing and hand-weaving become symbols of “uniqueness” and “handmade quality,” valued in luxury hotel and high-brand interiors. Paper, particularly traditional materials like washi, is increasingly used in lighting, partitions, and art panels, favored by architects and interior designers for being “lightweight and easy to handle yet rich in texture.”

These materials demonstrate their strengths more when planned at “spatial scale” or “collection scale” rather than individual sales, with the key being proposals that include “images when entering the space” using photographs and drawings.

Mixed Media and Contemporary Craft: Rising Prominence at Art Fairs

In recent years, what stands out at art and design fairs is mixed media combining multiple materials and the domain called “contemporary craft.” Works crossing materials such as ceramic × metal, wood × glass, and textile × resin are treated as entities transcending traditional “vessel” and “craft item” frameworks, receiving treatment closer to art objects and installations.

Such works emphasize not only technical perfection but also concept, narrative, and relationships to social and environmental themes, making artist statements and process explanations essential. Additionally, galleries are increasingly handling contemporary craft as “bridges between art and design,” with price ranges often set one tier higher than pure craft.

For craft businesses, while maintaining materials and techniques as core strengths, challenging combinations with different materials and expansion of spatial scale makes it easier to enter such contexts. Mixed media can be said to be a genre expected to rise in international markets as “craft’s next move.”

Purchasing Demographics and Price Segment

Looking at overseas craft and art markets, clear distinctions emerge regarding “who buys what at which price range and for what purpose.” Top collectors and museums emphasize future cultural value, viewing the “archival nature” of artists and works. Meanwhile, what has been growing particularly in recent years are middle-range demographics wanting to upgrade everyday interiors toward art, and new purchasing demographics casually buying works online.

They tend to select craft as “expressions of life and values” rather than speculation, making price range, size, and information clarity important. Here, we organize from top to bottom: top collector demographics, middle-range interior-oriented demographics, and new online-originated demographics, summarizing respective needs and price range images.

Needs of Top Collectors, Museums, and Corporate Collections

What top collectors, museums, and corporate collections seek is “whether the work can be discussed in value even 10 or 20 years from now.” The center of interest lies in the artist’s uniqueness, innovation in techniques and materials, positioning within contemporary contexts, and “archival nature” such as richness of records and documentation.

Price ranges for centerpiece works at solo exhibitions are in the several hundred thousand to several million yen scale, with even higher ranges possible for large installations or historically representative works. This demographic always confirms not just individual works but surrounding information such as catalogs, statements, exhibition history, and critiques.

Additionally, for museums and corporate collections, “how it connects to our institution’s/company’s story” is important, with tendencies to evaluate linkages to regional characteristics and social themes. From the maker’s perspective, rather than simply selling, this is a segment requiring long-term presentation in collaboration with galleries while verbalizing “where to position one’s work within what history and context.”

Expansion of Middle-Range “Art-Oriented Interior” Demographics

What has been growing most recently are middle-range interior-oriented demographics wanting to “place things with artistic qualities in homes and offices.” While they don’t seek museum-class collections, they find mass-market ready-made products insufficient and want to select “artist-made,” “one-of-a-kind,” and “handmade” items.

Price ranges center on small to medium-sized objects, vases, vessel sets, and wall pieces in the several tens of thousands to around 200,000 yen range. Points that resonate with this demographic are:

- Being able to concretely imagine the image when placed in space

- Artist and technique stories being briefly and clearly explained

- Sense of security that items can be used/displayed long-term

In online photographs and catalogs, “styling photos” showing items placed on tables or shelves are very effective beyond just close-ups of individual works. From a craft business perspective, preparing “lines with high artistic quality but controlled size and price” for this middle-range demographic makes it easier to grow both sales and recognition.

New Demographics Purchasing Online: Design Enthusiasts and Millennial Affluent

What has been rapidly expanding in recent years are new purchasing demographics buying craft items and art pieces online. At the center are design-savvy demographics and millennial-era affluent, with the style of “buying works from global artists online like traveling” becoming normalized.

Price ranges begin with small works up to several tens of thousands of yen, but as trust in artists and brands accumulates, works in the 100,000-300,000 yen class moving online is not uncommon. What this demographic emphasizes includes:

- Photo and video quality (360-degree views, visible details)

- Sense of security regarding returns, shipping, and damage handling

- “That maker’s worldview” felt through SNS and media

Since encounters with works often occur via algorithms, “searchable descriptions,” “shareable visuals,” and “multi-language communication including English” become key. From the maker’s side, alongside gallery-mediated sales, organizing online presentation and delivery methods can transform this new demographic into medium to long-term fans.

Position of Japanese Craft and Art

Japanese craft and art are often positioned overseas precisely between “craft” and “fine art.” The coexistence of functionality as everyday tools with advanced formative qualities and spirituality is a major appeal, with vessels, lacquerware, bamboo work, and woodwork being representative examples.

However, from the overseas market perspective, since classifications like “craft or art” and “living tools or objects” are not clear, incorrect positioning can easily lead to mismatched price ranges and presentation methods. What Japan should promote as strengths are high-precision techniques and material qualities, and storytelling backed by long history.

On that foundation, clarifying which market (art/design/lifestyle) to target as the main battlefield, and organizing verbalization and presentation methods will become increasingly important going forward.

Japanese Craft Evaluated Between “Craft” and “Fine Art”

Japanese craft is often evaluated overseas both as “high-quality craft” and simultaneously as an entity close to “conceptual art.” For example, ceramics and lacquerware supported by tea ceremony culture are vessels with utility, yet aesthetic consciousness is condensed in the balance of form, texture, and negative space, possessing viewing qualities comparable to fine art.

This “duality” is a major strength, but from the market side, it also creates an aspect of not knowing “which shelf to place it on.” If treated on the craft side, prices struggle to rise, while if shifted too far toward art, everyday usage becomes unclear, raising purchasing hurdles.

What is important is for artists and businesses themselves to clarify “whether to propose this work as craft entering daily life” or “place it in space as an art object,” designing size, series composition, price, and statements based on that premise. The strength of Japanese craft lies in the breadth allowing movement between both, but verbally defining that positioning becomes the first step in overseas expansion.

*”Fine art” primarily refers to pure art pursuing artistic value, while “craft” refers to handmade craft items with practical purposes. Fine art is typified by painting, sculpture, and music, while craft is characterized by the beauty of handwork accompanied by utility.

Popular Genres: Overseas Evaluation of Ceramics, Lacquerware, Bamboo Work, Metalwork, and Woodwork

Genres of Japanese craft particularly valued overseas include ceramics, lacquerware, bamboo work, metalwork, and woodwork. Ceramics, in addition to utility as vessels, are highly evaluated for earth textures and glaze expressions conveying “wabi-sabi,” with demand also as vases and objects.

Lacquerware has strong originality as a uniquely Japanese material and technique, with layered expressions such as roiro-nuri, maki-e, and kijiro easily treated as art pieces. Bamboo work, with beauty in structure and openwork, easily expands to lighting and wall objects, attracting attention from architecture and interior design as a material possessing “lightness and tension.”

Metalwork ranges widely from small tea utensils to large objects, with hammering marks and forged textures favored as “traces of handwork.” Woodwork crosses furniture, vessels, and objects, with minimal works utilizing wood grain and form having affinity with Nordic and European sensibilities. Since these genres already have foundations, “who to introduce next” and “how to differentiate presentation methods” are becoming competitive points.

Challenges: Information Dissemination, Pricing Strategy, Archive Organization, and Provenance Visibility

On the other hand, three challenges are cited as reasons why Japanese craft has not fully demonstrated its true value overseas: “information dissemination,” “pricing strategy,” and “archive organization.” First, in information dissemination, cases of insufficient artist introductions in English, technique explanations, and production process visualization are common, leaving work backgrounds inadequately conveyed.

In terms of pricing strategy, entering overseas markets with domestic market-aligned pricing can result in states of “too cheap causing concern” or “expensive without explained reasons.” Additionally, without organized provenance, exhibition history, and awards archiving, museums and top collectors view works as “having thin foundations for future value judgments.”

Since Japanese craft inherently possesses strong historicity and technical accumulation, properly recording, translating, and publishing this clarifies work positioning, connecting price and evaluation. Addressing these three challenges becomes the shortcut to maximizing Japanese craft’s potential in global markets.

Summary

The position of Japanese craft in overseas markets lies in a unique domain where “craft precision” and “art abstraction” coexist. Major genres such as ceramics, lacquerware, bamboo work, metalwork, and woodwork already possess strong evaluation foundations, with texture, structure, and material depth understood as international values.

However, challenges remain in information dissemination, pricing, and archive organization, with not few situations where works’ inherent power is inadequately conveyed. To enhance overseas evaluation, clearly designing “which market to position in,” “what narrative to explain with,” and “what evidence to present” is indispensable. By visualizing techniques, materials, and history, and thoroughly organizing English statements and provenance, Japanese craft will further strengthen its presence in global markets.